alameda county property tax payment

Sep 15 2022 Alameda County has its own mobile app for property tax payments. The Alameda County Treasurer-Tax Collector is pleased to announce that the AC Property App is now available on Apple devices.

How To Save Money On Property Tax In California By Duncan Medium

The median property tax in alameda county california is 3993 per year for a home worth the median value of 590900.

. Our Intuitive Search Tool Finds Alameda County Property Reports Quickly. 1 and is considered delinquent if not paid by 500 pm. Who do I make my check payable to.

A convenience fee of 25 will be charged for a credit card. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check s. The tax payment should be mailed to.

For payments made online there is no convenience fee for an electronic check from your checking or savings account. 1221 Oak Street Room 131. The TTC accepts payments online by mail or over the telephone.

Public property records provide information on. The system may be temporarily unavailable due to system maintenance and nightly processing. The facility is located at 5325 Broder Boulevard Dublin CA.

Alameda County Treasurer-Tax Collector. The mailing address is. Pay Your Property Taxes Online You can pay online by credit card or by electronic check from your checking or savings account.

You can place your check payment in the drop box located at the lobby of the County Administration building. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System. Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612 Home Treasury Tax Collection Deferred Compensation Contact Us Pay Your Property Tax Pay your.

If more than 15000 in sale proceeds remain. The valuation factors calculated by the State Board of Equalization and. The tax year must be entered as 4 digits ie 2002.

When property is sold at a tax sale the proceeds are used to pay the delinquent tax and assessment liens fees and costs of the sale. Ad Pay Your Taxes Bill Online with doxo. Dear Alameda County Residents.

A message from Henry C. Alameda County Property Taxes Payment With Credit Card If we are going to pay with the credit card option we will select the value fill in the terms acceptance box and click on the. Wondering what the payment schedule for Alameda County property taxes looks like.

Many vessel owners will see an increase in their 2022 property tax valuations. Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612. The valuation factors calculated by the State Board of Equalization and.

The first installment is due on Nov. You can lookup your assessed value property taxes and. Lookup or pay delinquent prior year taxes for or earlier.

Many vessel owners will see an increase in their 2022 property tax valuations. A message from Henry C. Dear Alameda County Residents.

Ad Need Property Records For Properties In Alameda County. You can mail in a check and make it payable to Treasurer-Tax Collector Alameda County. Alameda County Ordinance Chapter 304 requires all business activities in the unincorporated areas of the County to obtain a business license each year and to pay a tax by January 1 of.

The valuation factors calculated by the State Board of Equalization and. Dear Alameda County Residents. A convenience fee of 25 will be charged for a credit card.

Many vessel owners will see an increase in their 2022 property tax valuations.

Alameda County Property Tax News Announcements 01 31 2022

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Transfer Tax Alameda County California Who Pays What

City Of Oakland Check Your Property Tax Special Assessment

East Bay Residents May See A Drop On Their Property Tax Bill

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Transfer Tax Alameda County California Who Pays What

Home Treasurer Tax Collector Alameda County

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

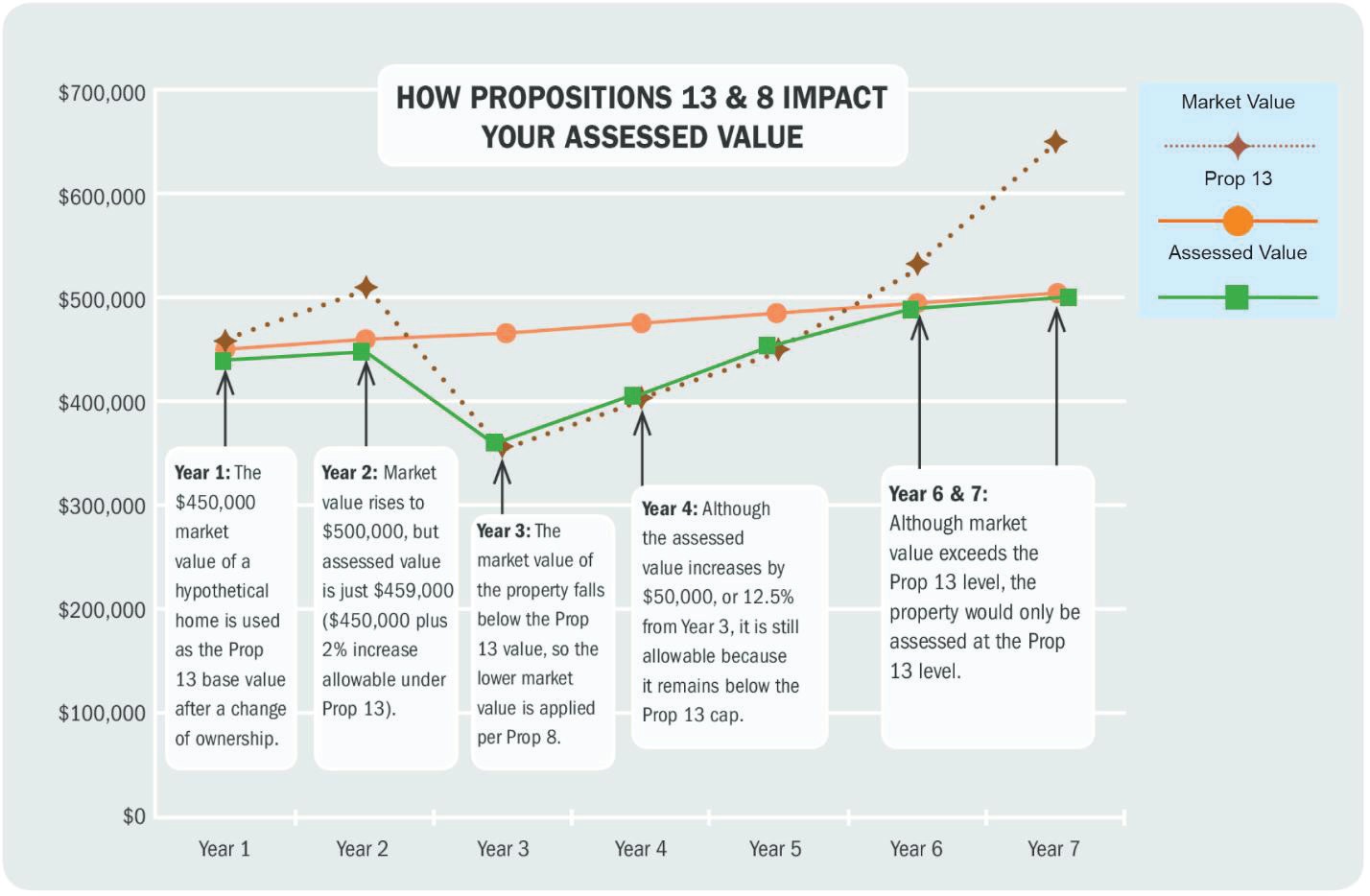

Property Tax California H R Block

Faqs Treasurer Tax Collector Alameda County

Property Tax Collection Treasurer Tax Collector Alameda County

Property Tax Calculator Smartasset

300 000 Tax Savings Haws Consulting Group

Alameda County Ca Property Tax Search And Records Propertyshark

Utla The Cocacola Plant In Alameda County Could Pay An Additional 422k Annually In Property Taxes If Assessed At Fair Market Value This Could Provide Support For Our Overworked Firefighters And

Michael Barnes Albany City Council Meeting Comments And More Page 2

Transfer Tax Alameda County California Who Pays What

How To Find And Research Pre Foreclosure Houses Properties Abdullah Yahya